Clarity. Simplicity. Reliability.

With complete advice that looks at every area of your life, you’ll be able to start each day feeling good about where you’re going. Your priorities are the basis for everything we do together.

What We Do

- Financial Planning -

Know What Comes Next

A personal financial plan takes worry off your shoulders because when you plan comprehensively, you can live confidently.

Every one of our client relationships begins with well-founded, whole-life advice that makes sense of your financial situation and organizes your life so you can understand what to do and when to do it.

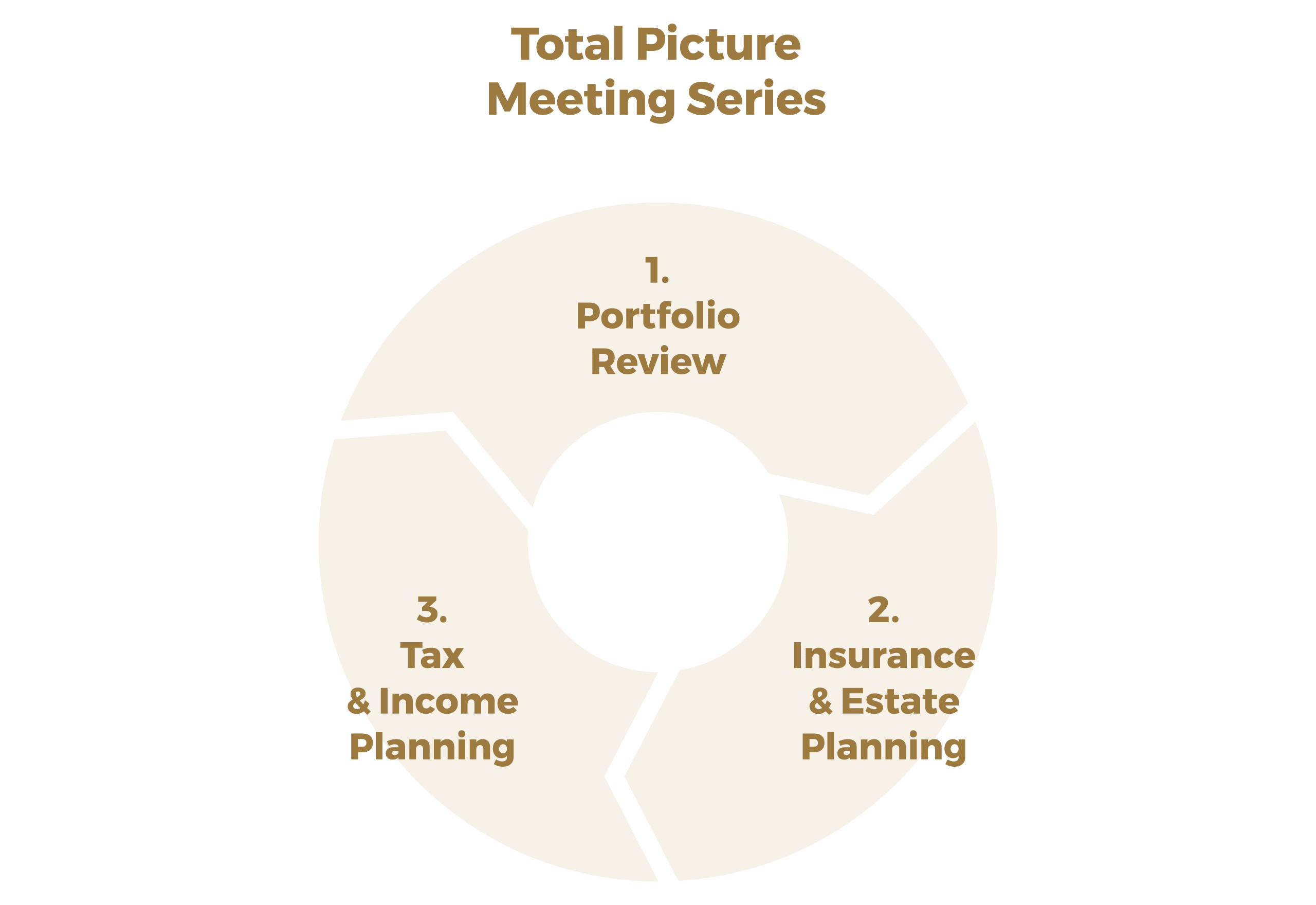

Our financial advice is delivered in a three-step process that looks at your financial life’s Total Picture:

Our initial planning process gets repeated annually so that planning becomes a constant loop of feedback. Your plan is never a “one and done” situation; we update it frequently to match your current lifestyle and goals.

- Investment Management -

Align Your Beliefs and Your Behavior

“Am I invested right?” is a question most people ask themselves. Too conservative, too risky…how do I know my money is in line with my mindset?

Removing extreme emotions from investing is the first step to making good decisions. To do that, we curate information with deep quantitative analysis of each person’s investments.

Simple asset allocation is not enough. We diversify by more than asset classes so we can make rational decisions even during irrational times.

- Protection Strategies -

Your Life. Protected

The best plans have a good backup plan so you can be comfortable even when life isn’t.

Protection strategies offer a way to manage your wealth responsibly by managing the risk of your entire situation.

We work with you to cover your entire lifetime.

Life

Life insurance is as much about emotional support as financial protection. If the unthinkable happens, we want you to know you’ll be taken care of—and if you don’t need it, life coverage can be an important part of a tax-efficient financial plan.

Disability

Annuities

Do you know how long you’re going to live? Of course not. That’s why we sometimes recommend annuities—they can help protect against the risk of outliving your money.

Long-Term Care

You should be able to live your best life until the end of your life. People often need regulated healthcare attention as they age, and that care should enhance the legacy you pass on, not diminish it.