If you’re looking at retiring soon, not outliving money in retirement should be one of your main concerns. Here’s what to know about living and spending with intention.

Transcript for Episode 5 of the Retirement Readiness Podcast:

Tim (0:10)

Hi, and welcome to the Retirement Readiness podcast. In today’s episode, we’re gonna be talking about how to not outlive your income when you’re in retirement. As you might know, we’re PrairieView Wealth Partners. We’re a family-focused, faith-centered financial planning and investment management company. Joining me today, as usual, is Katie Umland, our Head of Marketing. Katie, how are you today?

Katie (0:30)

Hi, how are you? Excited to get started today!

Tim (0:34)

Today, we’re going to talk about how to not outlive your income or your money when you’re in retirement. And, Katie, if I can kind of pick on you a little bit, I think that you’re in a place of life where maybe you’re not completely in that retirement phase, but you certainly are being affected by it. I think a little bit. Tell us a little bit, who watches Dylan for you when when you’re coming into work?

Katie (1:00)

Sure. So I work two days a week, typically, and my mom will watch him one day a week. And then my sister in law, Sarah, happens to be Tim’s wife will watch him the other day of the week.

Tim (1:12)

Yeah. For those that maybe don’t know, Katie is my sister, as well as our Head of Marketing. And this coming up week, if I’m remembering correctly, Katie, because of mom watching Dylan, you’re in a little bit of a pickle, right? Kind of difficult.

Katie (1:28)

She had the audacity to take a two-week European vacation without me and without Dylan, and now I’m without a babysitter.

Tim (1:39)

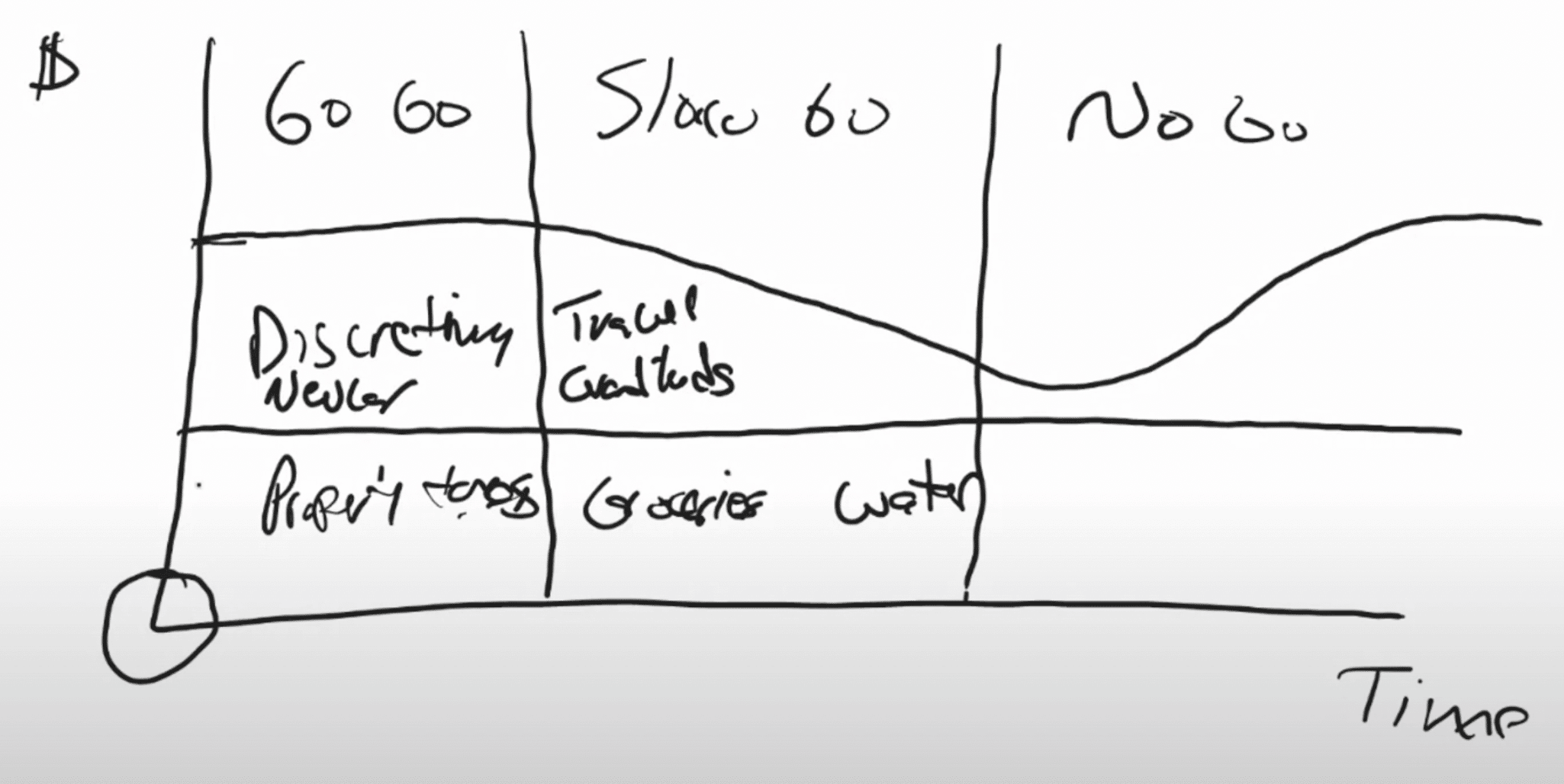

And so for a lot of our listeners or watchers, what you might be thinking is how does this have to do with me not outliving my retirement income, and making sure that I always have enough money? And really, what we’re experiencing… what Katie is experiencing is something very similar to what a lot of our retirees find happening. And we kind of call it the three stages of retirement. And so right now, the way we like to think about it, is that, you know, we picture over here we have money. And over here we have time. What happens is we find that for our clients, their retirement kind of gets divided into three different phases. They have what we call the “go go” years, then they have what we call the “slow go” years. Then we have what we call the “no go” years. And so, Katie, for our conversation for today, where does mom fall in?

Katie (2:43)

She’s still luckily, in the “go go” years, so she is always going and going.

Tim (2:48)

Yeah, 100%. And so what we find with some of our clients is we have to plan differently for each phases of their retirement. And what happens is, for most of our clients, at least, when they hit retirement age, and they’re starting here in time, what their fear is, is they recognize that you know what, I am no longer going to be able to go to work, I’m no longer going to make more money, everything I have, is all I’m ever going to have. And so they start thinking about how do I make my money last through all of these phases of retirement? And what we find is that we have to plan in a very specific and intentional way.

So, to start, what we think about is we picture some income that is going to be almost flat throughout your retirement. So let me kind of talk through a little bit what I mean by that. Down here we have things like property taxes. We have things like groceries. We have things like water, things that are your every day have to do them when you’re working. We used to call them… “MUG” was our hyphenation: mortgage, utilities and groceries, right? It’s the stuff that it takes for you just to live. And that’s going to be fairly consistent through much of your life.

Now, when you get out here into the “no go,” some of that might change a little bit. It might pewter off a little. But for the most part, we know these are the types of things that you’re going to be spending money on on a regular basis for the rest of your retirement. What we find is that there’s a money piece to this that kind of goes like this throughout your retirement, and what that does is we think about this money up here as kind of discretionary.

So we’re thinking about travel, think about grandkids, maybe a new car. Those are the things that you don’t necessarily have to do. But there are things that You’ll want to do throughout your retirement. And what you’ve what we find is that when you start out in you’re in the “go go” years, that discretionary money is pretty high compared to what it’s going to be when you start going to the “slow go,” and the “no go” years. Now, what you’ll notice, this kind of starts to dip up again, towards the end of the “no go.” And what we find is that many times as our clients get closer to kind of the end of life types of things, they start thinking about their living situation, and start choosing to say, maybe I want to go into a retirement type of a community and kind of experience of that, where maybe it can get a little more help and those things. So then you see the need for income start to increase a little bit. But in the beginning, we find all the fun stuff, the things that everybody thinks about doing in retirement, that happens during kind of those “go go” years.

Katie (5:52)

So where would you put the money mom and I spend on shopping and getting our nails done? Where does that fall?

Tim (5:59)

I think that that has to definitely go down here in this lower part because that’s not negotiable, right? Which, by the way, you probably don’t do that very often. Right? Did you just get your nails done yesterday?

Katie (6:14)

I think yesterday.

Tim (6:18)

So even in our house, when we think about things like where do we spend our money and how do we spend our money, it’s really similar when you’re working versus when you’re retired. The difference is that when you’re retired, during these “go go” years, you’ve got all this discretionary time, along with the ability to spend discretionary money. And I have never met anybody who thought “When I retire, I really hope I can do nothing. I really hope I sit and do nothing. I don’t go shopping. I don’t enjoy grandkids. I don’t get to travel. But I’m really strapped with money.” And you probably have seen that, Katie, even with some of our other clients that kind of fit that bill.

Katie (6:56)

Yeah, definitely. And mom always says, “I want to spend my money on my grandkids, not just leave it for them. I want to do stuff with them and my kids!”

Tim (7:07)

Yeah, for sure. And so when we start thinking about how do we transition, or how do we manage money through those transitions, what we start thinking about and the way that we have to be with making sure that we don’t outlive that money, is being really intentional with how we layer things in. So over here, under the for this “We need this money,” we think about fixed income stuff, we think about things like social security, or pension. Maybe we think about an annuity. And basically, what that says is that for the rest of your life, you know that you have all the basics covered. We don’t ever have to worry about you running out of money.

So, you know, you’re always getting your nails done, you’re always able to go shopping, you’re always able to live in the house that you’ve got. Then, up here is when we manage your portfolio or your investments in order to make sure that your discretionary needs are also being met. Now, you’ll notice that over time, this starts to kind of decline a little bit. And so one of the things that we actually talk to our clients about is, how do we manage your portfolio so you almost overspend when you’re on this side in the “go go” years, how do you overspend a little bit to do more discretionary stuff? While you’re healthy? While you’ve got the income in order to do that?

Katie (8:35)

Well, if anybody needs tips on that, I am your girl!

Tim (8:41)

I thought you had the money spending part down.

Katie (8:47)

Overspend? Check!

Tim (8:50)

Maybe Alex and I should be having this conversation. Yeah, so as we think about a lot of that, some of those same things that you struggle with while you’re working, you bring those same skill sets into retirement. The difference is, again, people start to realize: “I can’t just go out and make more, because I have stopped working.” And so the key is, how do I balance it? How do we know the right amount to spend? Which is kind of funny.

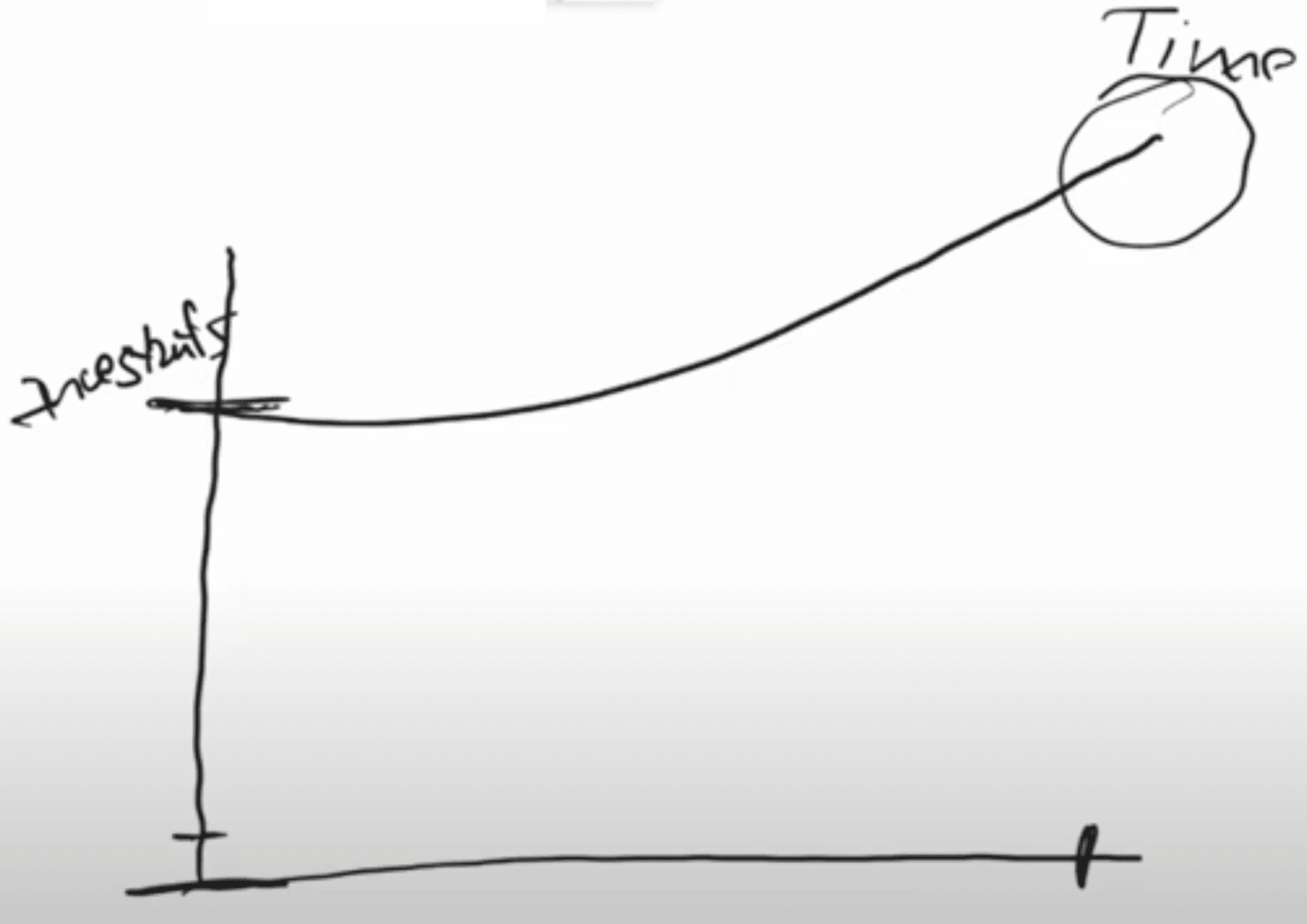

So one of the things that we find with with clients is that they think about their retirement kind of like this. So they picture: “I’ve got this much money in my retirement.” And over time, you know, we kind of go out this way. And now I have my investment portfolio here. They think, “I don’t want this to run out.” And so they get so nervous about not running out of money, that sometimes they only spend this much money and then all of a sudden they get out here and their investment portfolio has done that. So kind of what you were talking about earlier when you said, “Hey, I know my mom always says, ‘I want to spend money on my grandkids now. I don’t want to leave it to them.'”

Well, a lot of times, what we find is that we have clients that are so conservative in the beginning, that they’re worried about spending their money, they’re worried about outliving it, so they don’t spend enough. And so then when we look at where they could be spending their income, their discretionary spending, they don’t take advantage of the stuff that they could. So their lifestyle is really restricted, compared to what it could be. And then all of a sudden, they get out here in life and they’re like, “Holy cow, I got all this money, and I don’t know what to do with it. I should have spent it when I was younger, and I had the ability to do so.” And so that’s why it really matters how we put together that income plan to make sure that you’ve got enough that is always stable and guaranteed. We want to know that your lifestyle, your core, basic needs are always going to be met. Then we have to have a plan for how much money can you spend and how much money can you continue to spend to fill that discretionary bucket to live the most successful life that you can.

So, as you look at that, feel free, if you’ve got questions, reach out to a professional, whether it’s us or another financial professional. Actually, we prefer it to us. Katie, I know that you being the Head of Marketing, you definitely prefer they call us. But when you think about how you can put this plan together, reach out and let’s talk about putting that that plan together for you and making it specific so that we can help you live your legacy with confidence.

Katie (11:31)

And if you found any of this valuable, don’t forget to like and subscribe to our YouTube page and our Facebook page. We’ll see you again next week.

Tim (11:41)

Join us for future episodes of the Retirement Readiness podcast where we’re going to take this show on the road. Our first stop is going to be at Smith Senior Living, a retirement life plan community right here in Orland Park, on the south side of Chicago. In addition to that, we’re going to start with other local businesses as we try to show you other ways that potentially you could help to live your retirement with purpose. See you soon.

Explore more financial insights and news on the PrairieView blog, and be sure to check out our other “Retirement Readiness” episodes!