Retirement planning is about a lot of things: where you’ll live, what you’ll do, who you’ll interact with… and then there’s retirement income planning, which is about how you’ll pay for everything. Understanding your maximum social security benefit is essential to retirement planning.

One of the most common building blocks of your retirement income is Social Security benefits.

Social Security is a limited resource – the Social Security Administration (SSA) denotes a maximum amount each individual (and even each family) can receive.

Today, we’re exploring how you can calculate your Social Security benefits maximum, or the most you can expect to receive in benefits each year.

Understanding Social Security Benefits Maximums

The SSA manages and distributes several types of benefits, including retirement, disability and survivor benefits (for those who lose a qualified loved one). In today’s case of calculating maximums, we’re talking specifically about retirement benefits.

Retirement benefits have a maximum per individual. Your maximum benefit depends on several factors – age of retirement, how much you paid in throughout your life (which is based on your income), and so on.

For example, someone who retires in 2023 at 70 years of age could receive up to $4,555 per month, while a 62 year old retiring this year would be capped at $2,572 per month. However, that’s not the same numbers every 70-year old and 62-year-old will receive – it also depends on how much they earned and paid into the program throughout their working years.

Investopedia explains:

“To receive the maximum Social Security benefit, you would need to earn at least the maximum wage taxable by Social Security for 35 years and delay claiming the benefit until you reach 70.”

These maximum taxable income amounts change over the years – the maximum taxable wage in 2023 is $160,200, while in 2022 it was $147,000.

Calculating Your Social Security Benefit

The SSA uses a somewhat complex calculation to determine your specific benefits, so let’s recap the main points:

Earnings history: One of the biggest factors in this equation is your earnings history. As we stated above, the SSA uses your 35 highest-earning years in the workforce averaged together. If you only worked 25 years, the last ten would be counted as $0 earning years.

Age: Another big factor is your age. Technically, you can start withdrawing your Social Security benefits anytime between the ages of 62 and 70. The longer you wait, the more money you’ll receive in total.

Cost of living: The SSA also accounts for inflation via “cost of living adjustments,” also known as COLAs. Although the goal is to keep payments in pace with inflation, it’s not always that straightforward. Inflation can impact different people and areas of the country in unequal ways, for instance.

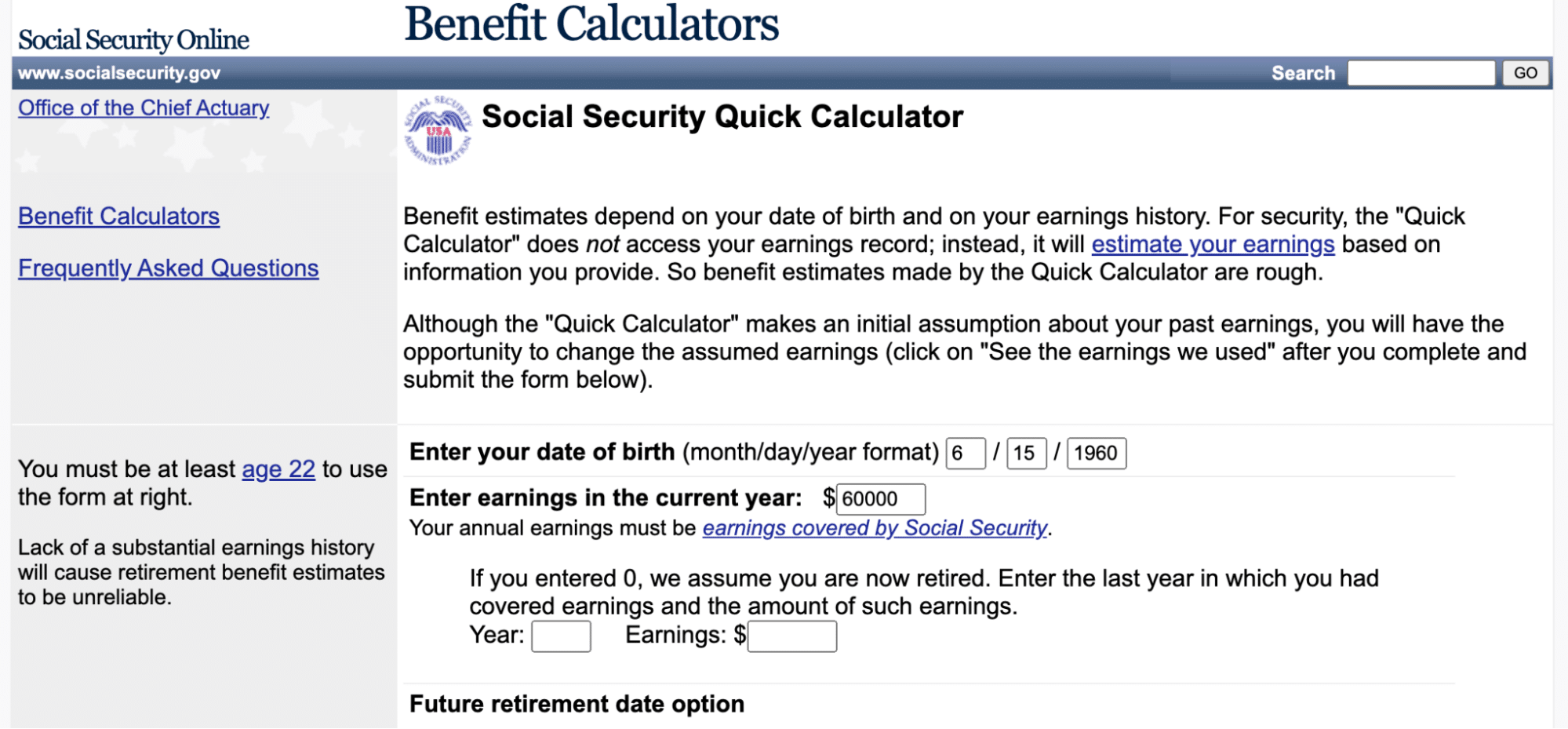

Rather than trying to do the calculation by hand, we recommend you use the SSA’s free calculator, which can help you estimate your benefit with just a few key pieces of information.

Click here to access the Social Security Administration’s Quick Benefits Calculator

Strategies to Maximize Your Social Security Benefit

When it comes to maximizing your Social Security benefits, there are several strategies you can consider to ensure you get the most out of this vital retirement resource.

-

Delay claiming benefits (if it makes sense)

One of the fundamental strategies for maximizing your Social Security benefits is to delay claiming them. Social Security benefits increase every year you wait to claim them, up until age 70 – yet only 10% of people wait until 70 to start claiming!

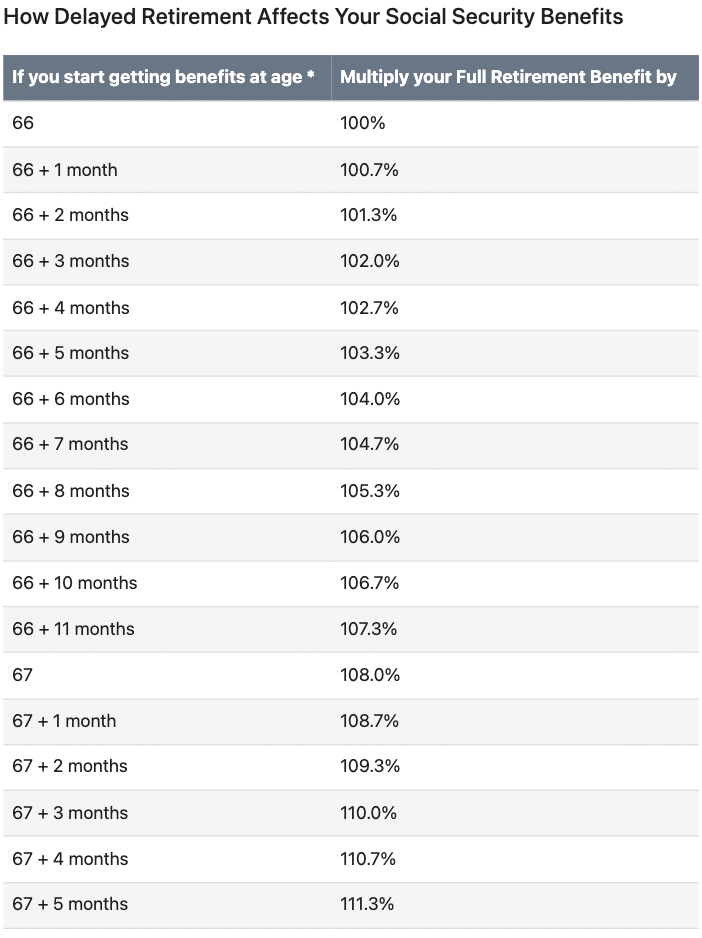

For each year you delay, your monthly benefit will grow, potentially leading to significantly higher monthly payments when you do start receiving them. As of 2023:

- If you start collecting before the age of 66, you’ll get less than 100% of your full benefit.

- If you wait until 66 years old you’ll get exactly 100%.

- Those that start collecting at 67 years old will likely receive 108% of their benefit,

- Those that wait until the maximum age (70) will receive 132% of their benefit.

- After the age of 70, there is no increase in benefit.

Click the image below to view the full 2023 benefits chart provided by the SSA.

Do keep in mind that the decision to delay should be based on your unique circumstances. If your life expectancy is longer and you have a family history of longevity, waiting to claim benefits can be a wise move. On the other hand, if your family history shows a shorter life expectancy or you suffer from health conditions that are likely to shorten your life, waiting might not be as beneficial.

-

Pay attention to taxes

Social Security benefits can be subject to federal income tax, depending on your overall income. The SSA writes:

“You must pay taxes on up to 85% of your Social Security benefits if you file a:

- Federal tax return as an “individual” and your “combined income” exceeds $25,000.

- Joint return, and you and your spouse have “combined income” of more than $32,000.”

You may wish to coordinate your (and your spouse’s) various income streams to minimize your taxable income, leading to more money kept in your pocket.

-

Work with a financial advisor

Navigating the complexities of Social Security and retirement planning can be a daunting task for even the simplest cases – that’s where a financial advisor comes in.

A financial advisor brings a wealth of knowledge and experience to the table, staying up-to-date with the latest rules and regulations surrounding Social Security. They can provide you with personalized guidance tailored to your specific financial situation and retirement goals. If you’re looking for help in calculating your maximum benefits, or strategies for optimizing your overall benefit amount, an advisor’s help can be invaluable.

And once you have an estimate of your maximum Social Security benefit, you’re better equipped to plan for your future retirement.

Connect with an Advisor

Our team of advisors are experienced in comprehensive retirement planning and can help you plan your Social Security benefits. Click here to connect with a member of our team and get started today.

[Disclosure]

PrairieView Wealth Partners, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website prairieviewwealthpartners.com for important disclosures.

PrairieView Wealth Partners, LLC often communicates with its clients and prospective clients through email and other electronic means. Your privacy and security are very important to us. PrairieView Wealth Partners, LLC makes every effort to ensure that email communications do not contain sensitive information. If you are not the intended recipient of this communication, please delete and destroy all copies in your possession, notify the sender that you have received this communication in error, and note that any review or dissemination of, or the taking of any action in reliance on, this communication is expressly prohibited. We remind our clients and others not to send PrairieView Wealth Partners, LLC private information over email. If you have sensitive data to deliver, we can provide secure means for such delivery. Please note PrairieView Wealth Partners, LLC does not accept trading or money movement instructions via email. Please visit our website prairieviewwealthpartners.com for important disclosures.

Please remember to contact PrairieView Wealth Partners, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request.

The information provided herein is for informational purposes only and does not constitute financial, or legal advice. Investment advice in an advisory capacity can only be rendered after delivery of PrairieView Wealth Partners, LLC’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and PrairieView Wealth Partners, LLC.