What happens to your health insurance after you retire?

Healthcare is a significant cost for most Americans, and that expense usually grows in retirement as health declines and your odds of sustaining an injury rise. But once you leave the workforce, there’s a good chance you’ll lose that employer-sponsored insurance plan – then what?

This question becomes more important as you consider just how expensive healthcare in retirement can be – one report from Fidelity shows that a retired couple will need north of $300,000 set aside in retirement just for health-related costs. Yet it’s estimated that the average American will have just $255,200 saved up by the time they reach retirement age. With numbers like that, many Americans are left wondering how they’ll afford even routine healthcare needs.

The answer could lie in Medicare, a healthcare benefits program available to certain retirees and those with a qualifying disability. Let’s explore the basics of Medicare, including how you can figure your age of eligibility.

What is Medicare?

According to the official Medicare website, “Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).”

The Medicare program paid out $829 billion in total in 2021 – most of which comes from Medicare Part B, accounting for 48% of the budget.

CNBC reports that more than 62 million people were enrolled in Medicare as of 2020, and the average recipient has about two-thirds of their healthcare services covered by the program.

The Many Layers of Medicare

There are several different pieces to Medicare. For example, Medicare Part A is specifically intended to cover inpatient hospital stays, skilled nursing facility care, hospice care and some home health care. Part A is usually paid through taxes from your working years and often doesn’t require a monthly premium.

Medicare Part B is for more generalized medical care, such as outpatient care, doctor’s services, preventive services and more. Part B usually comes with a monthly premium you’ll need to pay.

Part D is for prescription drug coverage, and is offered through private insurance companies. Those who choose to participate in Medicare Part D can shop around for the best plan per their specific needs.

What are Medicare Advantage and Medigap?

Medicare Advantage is also known as Medicare Part C. Think of Part C is a private insurance option that essentially combines Part A and B, but often include additional benefits like vision or dental coverage. If you choose a Medicare Advantage plan, you’ll likely need to pay the Part B premium along with any additional premium required by the Medicare Advantage plan.

If you want additional coverage, Medigap could be another great choice. Medigap plans are offered by private insurance companies and aim to cover some of the “gaps” in original Medicare plans, such as copayments, coinsurance and deductibles.

To qualify for Medigap, you must already be enrolled in Medicare Part A and B. There are a variety of Medigap plans available, each with a different combination of benefits.

Medicare vs. Medicaid

These two are often confused, but are actually separate programs. The U.S. Department of Health and Human Services notes:

“Medicare is federal health insurance for people 65 or older, and some people under 65 with certain disabilities or conditions. Medicaid is a joint federal and state program that helps cover medical costs for some people with limited income and resources.”

Medicare Eligibility: At What Age Do You Qualify?

Medicare is available to those aged 65 years and older or who have a qualifying disability. However, you can actually first sign up for Medicare three months before your 65th birthday. While you often don’t have to enroll at 65 years old, it’s important to understand the rules so you can avoid any late enrollment penalties (more on that below).

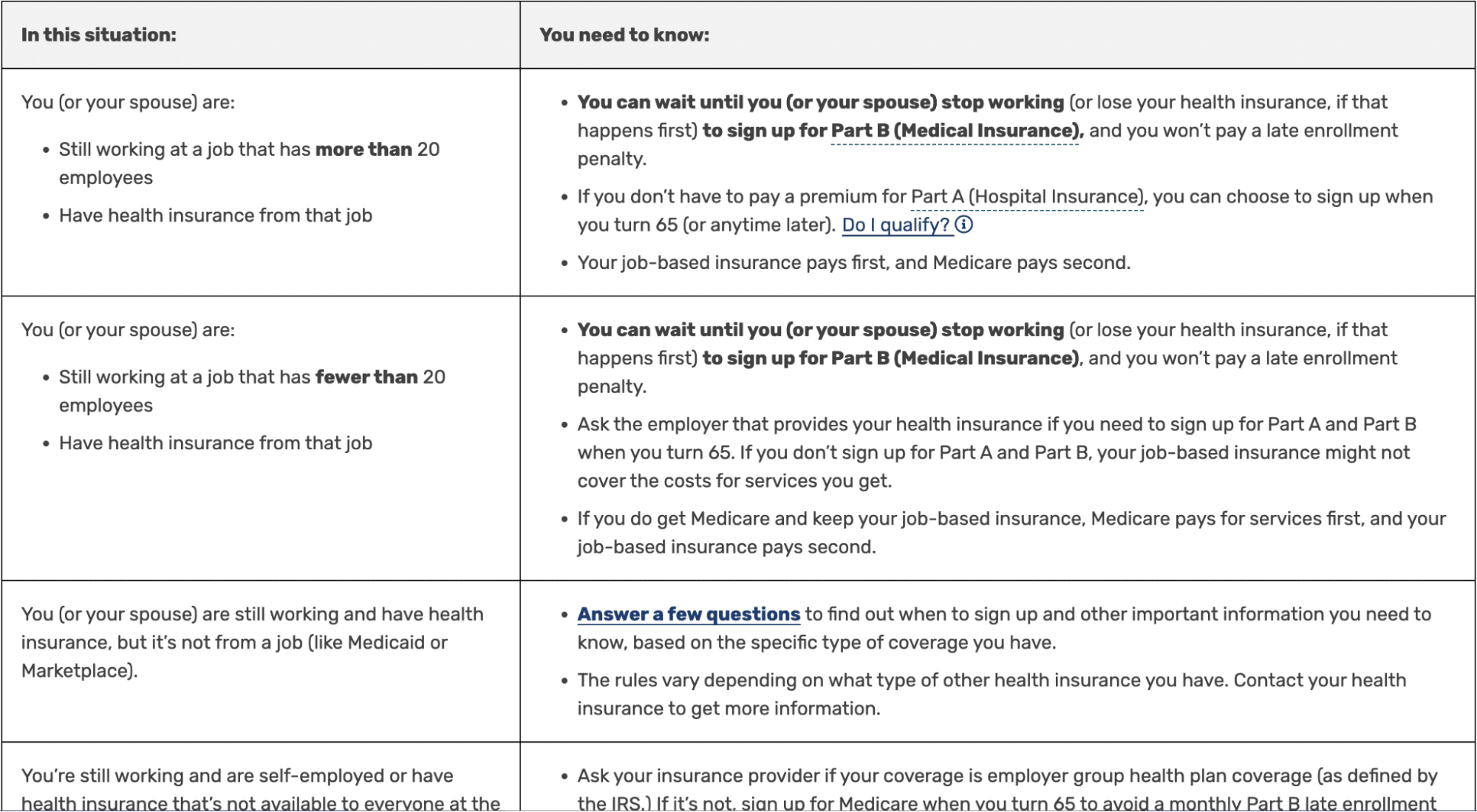

If you choose to continue working past the age of 65, you may be able to collect both your employer-sponsored insurance plus Medicare. In this case, the employer-sponsored will pay first, and then Medicare. Many factors, such as your employee benefits, company size and marital status, can affect your specific enrollment requirements.

You can view a chart of common exceptions to the “age 65” rule by clicking the image below:

How Can You Avoid Late Penalties?

Late enrollment penalties can occur if you don’t sign up for the proper Medicare plans on time according to your circumstances. Penalties aren’t just a one-time payment – they’re a monthly charge that could last the rest of your life, so it’s crucial to avoid them!

To dodge those extra charges, most people need to enroll in Medicare during their initial enrollment period, which ends three months after the month of your 65th birthday.

Humana writes:

“If you’re not eligible for premium-free Part A based on your work history, your monthly premium may increase if you don’t purchase it when you are first eligible. In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a penalty – and not just upon enrollment. You’ll continue to pay that penalty for as long as you’re enrolled in Medicare Part B.”

The many facets of Medicare can be confusing – and a small error could cost you big bucks. To ensure you get enrolled in an appropriate plan at the right age, it’s best to consult with a qualified professional.

Start the Conversation Today

Medicare is an important part of retirement planning, and understanding its various functions, costs and options is essential for a financially secure and healthy retirement. Click here to consult with a financial advisor who specializes in retirement planning and healthcare to get started today.

[Disclosure]

PrairieView Wealth Partners, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website prairieviewwealthpartners.com for important disclosures.

PrairieView Wealth Partners, LLC often communicates with its clients and prospective clients through email and other electronic means. Your privacy and security are very important to us. PrairieView Wealth Partners, LLC makes every effort to ensure that email communications do not contain sensitive information. If you are not the intended recipient of this communication, please delete and destroy all copies in your possession, notify the sender that you have received this communication in error, and note that any review or dissemination of, or the taking of any action in reliance on, this communication is expressly prohibited. We remind our clients and others not to send PrairieView Wealth Partners, LLC private information over email. If you have sensitive data to deliver, we can provide secure means for such delivery. Please note PrairieView Wealth Partners, LLC does not accept trading or money movement instructions via email. Please visit our website prairieviewwealthpartners.com for important disclosures.

Please remember to contact PrairieView Wealth Partners, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request.

The information provided herein is for informational purposes only and does not constitute financial, or legal advice. Investment advice in an advisory capacity can only be rendered after delivery of PrairieView Wealth Partners, LLC’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and PrairieView Wealth Partners, LLC.