Although PrairieView Wealth Partners is situated in Illinois, did you know that our main office is just 23 minutes from the Indiana border?

As close neighbors, we have worked with many Indiana-based retirees, helping them craft a retirement plan based on not only their goals, but the specific tax and estate planning laws that vary from one state to the next.

Related: 9 FAQs You Should Know if You Plan to Retire in Illinois

Where you decide to retire is important, and knowing which state you plan to retire in ahead of time can guide your financial decisions to optimize your current and future income.

If you’re envisioning a two-comma life situated in the great Hoosier state, we’ve got you covered – here are ten common questions (and answers) about retiring in Indiana.

10 FAQs About Retiring in Indiana

1. What’s the cost of living for retirees in Indiana?

CNBC estimates that the annual cost of a comfortable retirement in Indiana is about $58,789, but it’s important to note that your specific lifestyle can greatly increase or reduce that number. Additionally, inflation and rising costs of living will likely change that number from one year to the next.

Indiana legislators have also recently begun studying just what to do about the cost of living for certain individuals who work for the state of Indiana and earn pensions, and are considering a permanent 0.5% annual increase in pension benefits for affected folks. Although final decisions aren’t expected in 2024, it’s worth keeping an eye out if you may be impacted by those changes.

2. Does Indiana tax retirement income?

Yes, Indiana has a flat income tax rate of 3.15% that applies to pensions, IRAs, and 401(k)s. A flat rate means that the tax rate will be the same for all persons regardless of their income or filing status. In contrast, some states opt for a progressive income tax rate, which increases as you make more money, while other states have no income tax at all, such as Alaska, Florida, and Nevada.

3. Are pensions taxable in Indiana?

Yes, pensions are taxed at the state’s income tax rate of 3.15%.

4. Does Indiana tax military retirement?

No, military retirement benefits are exempt from state taxes in Indiana. Indiana is one of 26 states that do not tax military retirement benefits.

5. Does Indiana tax Social Security income?

No, your Social Security income won’t be taxed in Indiana. If you decide to retire in the Hoosier state, you’ll be able to deduct any Social Security retirement income on your tax return.

Related: Listen to our Retirement Readiness Episode 35, “Maximizing Social Security Benefits”

As of a 2021 report from the Social Security Administration, over 124,000 Indiana residents were collecting benefits – all income tax-free.

6. What is the average cost of long-term care in Indiana?

Genworth says the median cost of a home health aide in 2024 for Indiana residents is $5,209 per month. An assisted living facility sits around $4,680, while a private nursing home room costs around $9,507.

That cost will vary depending on your specific location. For example, a recent report showed that assisted living care in Lafayette and Terre Haute is higher than state averages, while those in South Bend and Fort Wayne enjoy lower median costs.

7. Does Indiana have an estate tax?

If you’re planning on bequeathing substantial assets to your children or grandchildren, you’ll be happy to know that Indiana does not levy an estate tax. Note, however, that your assets may still be subject to federal estate taxes, which apply to all estates worth $13.61 million or more in 2024.

8. What estate planning tools are available in Indiana?

There are a variety of estate planning tools available in Indiana, including:

- Living Will: Specifies your preferences for end-of-life medical treatments.

- Last Will and Testament: Outlines how you’d like your assets to be distributed upon your death. Allows for the appointment of guardians for minor children.

- Revocable Living Trust: A trust that can be altered or revoked during your lifetime. Avoids probate, providing privacy and potentially faster distribution of assets.

- Power of Attorney: Grants authority to a designated person (agent) to make financial or legal decisions on your behalf, usually in cases of incapacity.

- Health Care Proxy or Medical Power of Attorney: Authorizes someone to make healthcare decisions on your behalf.

9. What does Medicare cost in Indiana?

Medicare comes in several parts – each of which covers various healthcare costs. You may be enrolled in just one part or multiple plans, so nailing down an exact cost estimate is difficult.

Related: Everything You Need to Know About Medicare’s 8-Minute Rule

However, the Indiana Department of Insurance does provide data that can be useful. For example, while Medicare Part A (which covers hospital care) is usually free, it can cost between $232 and $505 depending on your credits.

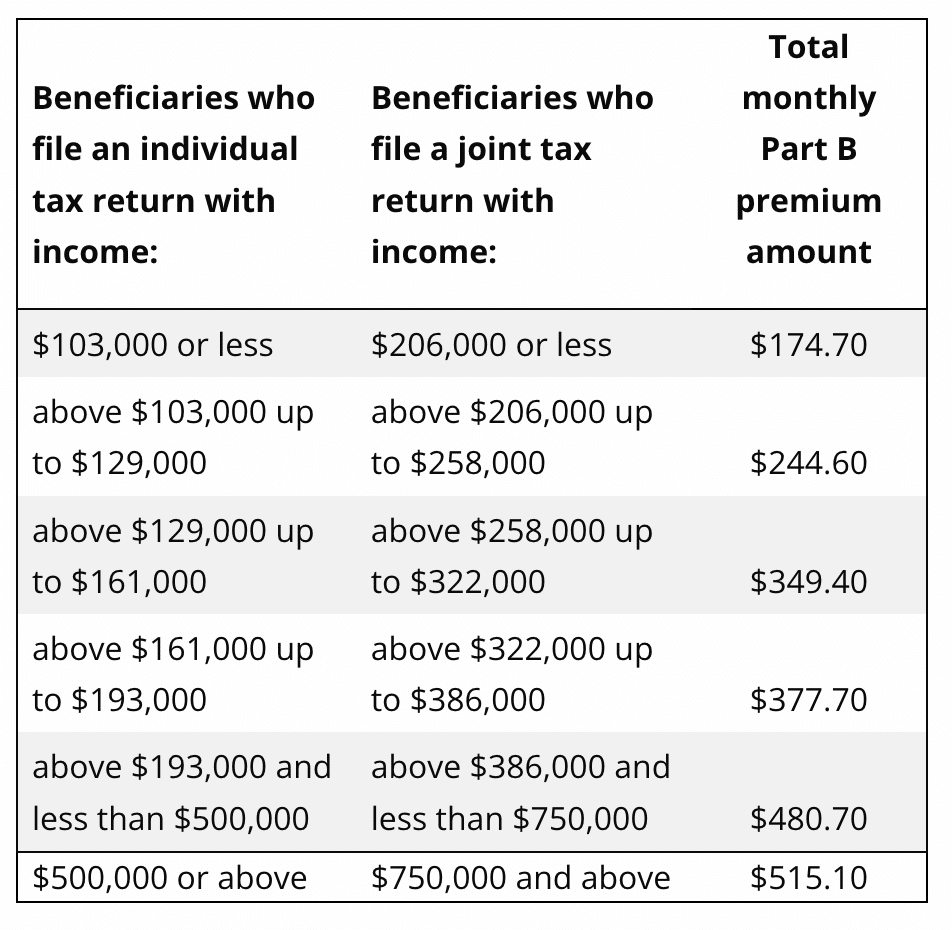

Meanwhile, Medicare Part B (which covers outpatient care, doctor’s appointments, etc.) has a variety of premiums based on your income:

*Source: https://www.in.gov/ship/medicare-coverage/#6

10. Should you retire in Indiana?

Choosing a location for your retirement is a personal decision – one that should factor in your lifestyle, budget, healthcare needs, family and more. As Indiana-adjacent financial planners, we’ve helped several Hoosier retirees plan for and enjoy a happy, healthy and fulfilling retirement!

Related: Retiring in 2024: Financial, Legal, Healthcare and Lifestyle Considerations

With a flat income tax rate, Social Security and military exemptions and other key financial benefits, Indiana can make a great state for your retirement needs.

Live Your Two-Comma Life with Confidence

Looking forward to your retirement? Want to have a plan in place before you get there? Click here to schedule a consultation with a member of the PrairieView team and get started.

[Disclosures]

PrairieView Wealth Partners, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website prairieviewwealthpartners.com for important disclosures.

PrairieView Wealth Partners, LLC often communicates with its clients and prospective clients through email and other electronic means. Your privacy and security are very important to us. PrairieView Wealth Partners, LLC makes every effort to ensure that email communications do not contain sensitive information. If you are not the intended recipient of this communication, please delete and destroy all copies in your possession, notify the sender that you have received this communication in error, and note that any review or dissemination of, or the taking of any action in reliance on, this communication is expressly prohibited. We remind our clients and others not to send PrairieView Wealth Partners, LLC private information over email. If you have sensitive data to deliver, we can provide secure means for such delivery. Please note PrairieView Wealth Partners, LLC does not accept trading or money movement instructions via email. Please visit our website prairieviewwealthpartners.com for important disclosures.

Please remember to contact PrairieView Wealth Partners, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request.

The information provided herein is for informational purposes only and does not constitute financial, or legal advice. Investment advice in an advisory capacity can only be rendered after delivery of PrairieView Wealth Partners, LLC’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and PrairieView Wealth Partners, LLC.