It seems like every day brings another example of why it’s so important to account for medical in your long-term financial plans. Fidelity reports that a 65-year old in 2023 could need about $157,500 saved after taxes just to cover healthcare costs in retirement. And a married couple with the same demographics could need north of $300,000.

That’s why it’s so important to understand the benefits and programs available that could help alleviate those costs – programs like Medicare.

We’ve covered some of the basics of Medicare before, like what age you can qualify and how it can affect your golden years. Today, we’re continuing that journey and diving into the Medicare 8-minute rule: What is it, which services qualify, pros and cons you can expect and more.

What is the Medicare 8-Minute Rule?

The 8-minute rule (sometimes called the “Medicare rule of 8”) is a time-based billing system used by Medicare to calculate costs for services under Part B.

Related: What’s the Difference Between Medicare Parts A, B, C and D?

With this system, medical offices keep track of the time you spend directly with the doctor or provider and then break it down into “units.” You are then billed based on the number of units reported. The cost of a unit depends on your specific Medicare plan.

To be clear, one unit does not equal one minute – that’s why it’s called the 8-minute rule! You must spend at least eight minutes (but less than 22 minutes) directly with the provider for it to count as a single unit. After 22 minutes, you’ll accrue units in 15-minute increments.

It may sound complicated, but it’s fairly simple. Let’s look at some real world examples to better understand how units are calculated.

Understanding the math behind the 8-minute rule

Imagine you are a Medicare patient and you have a physical therapy session today. Under the 8-minute system, you know that the cost will depend entirely on how much time you spend with the physical therapist.

Your appointment begins at 10 a.m. and ends at 11:07 a.m., meaning you spent a total of 67 minutes with the specialist. So what is that in terms of billable units?

The answer is four units. But why?

If you spend just five minutes in the session, no units will be billed, because it doesn’t meet the eight-minute minimum.

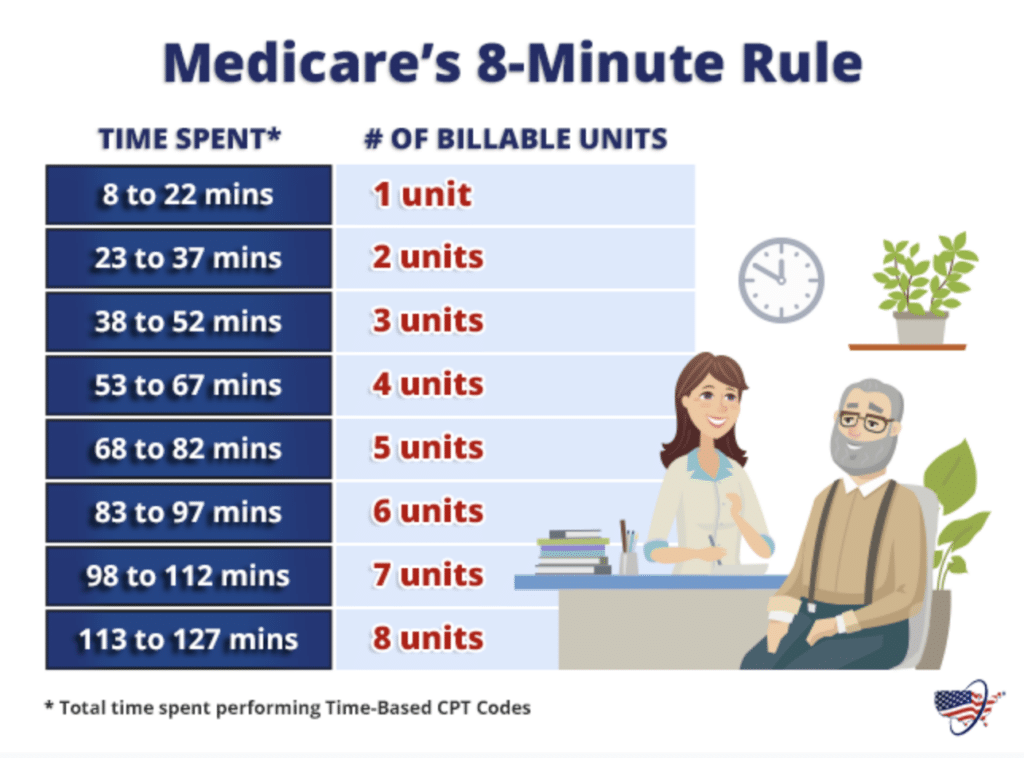

If you spend anywhere between eight and 22 minutes with the therapist, you’ll be billed for one unit. If you spend between 23 and 37 minutes, you’ll accrue two units. Between 38 and 52 minutes would be three units, and so on.

There are a number of great charts out there that break down the units, like the one below from MedicareFAQ.com.

What Services Do (and Don’t) Fall Under the 8-Minute Rule?

It’s important to note that not all medical care is billed with the 8-minute rule – it can vary depending on the facility, care received and the specific provider or doctor, among other factors. And, of course, you also need to be a Medicare Part B beneficiary for it to apply.

*Note: To be certain about the billing process used, you’ll need to check directly with the facility or your Medicare plan.

Some services that often do fall under the rule include:

- Physical therapy, occupational therapy and chiropractic care

- Mental health and rehabilitation services

- Speech/language pathology

- Hospital outpatient care (often including emergency services)

- Some nursing facilities and other private practices

Remember that only the time you spend individually and directly with the provider counts toward the total billable time – any time the doctor spends preparing for the appointment or updating your records afterward does not. Group services like small-group physical therapy also wouldn’t be applicable.

Pros and Cons of the 8-Minute Rule

There are a few benefits and drawbacks to the 8-minute rule for both patients and providers.

For example, the rule encourages accurate time-tracking in outpatient medical facilities, which provides better documentation of care. However, the time it takes to actually do that time-tracking adds an extra burden to medical providers and their staff – giving them less bandwidth to spend with patients and increasing operational costs. It can also be tough for Medicare to enforce proper time-tracking across all qualified facilities.

Additionally, all care under the 8-minute rule must take place in-person, so virtual care doesn’t count. One recent study found that telehealth appointments increased by 766% in the first few months of the Covid-19 pandemic, and that trend toward digital care appears to be sticking around, remaining a popular choice for many who have trouble commuting to doctor’s offices.

However, fans of the 8-minute rule enjoy the standardized aspect of the billing process. Simply by knowing how much time they’re spending one-on-one with the doctor, patients can accurately calculate their costs.

How Does the 8-Minute Rule Factor into Your Financial Plan?

By understanding how your services will be billed, you can better plan for your healthcare costs in retirement – especially if you think you’ll need substantial outpatient care that falls under the 8-minute rule, like long-term mental health treatment.

Having a strong understanding of your potential expenses is also part of building the two-comma lifestyle we often talk about at PrairieView Wealth Partners (“two-comma” is the term we use for those that reach millionaire status before retirement).

So if you’re likely to enroll in Medicare (or already are enrolled), consulting with a financial advisor and researching the intricacies of Medicare billing processes are great ways to get started.

Make the Most of Your Medicare Benefits

Interested in learning more about how Medicare could factor into your retirement plan? The PrairieView team provides personalized guidance built around your individual needs and goals. Click here to connect with a member of our team and get started today.

[Disclosures]

PrairieView Wealth Partners, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website prairieviewwealthpartners.com for important disclosures.

PrairieView Wealth Partners, LLC often communicates with its clients and prospective clients through email and other electronic means. Your privacy and security are very important to us. PrairieView Wealth Partners, LLC makes every effort to ensure that email communications do not contain sensitive information. If you are not the intended recipient of this communication, please delete and destroy all copies in your possession, notify the sender that you have received this communication in error, and note that any review or dissemination of, or the taking of any action in reliance on, this communication is expressly prohibited. We remind our clients and others not to send PrairieView Wealth Partners, LLC private information over email. If you have sensitive data to deliver, we can provide secure means for such delivery. Please note PrairieView Wealth Partners, LLC does not accept trading or money movement instructions via email. Please visit our website prairieviewwealthpartners.com for important disclosures.

Please remember to contact PrairieView Wealth Partners, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request.

The information provided herein is for informational purposes only and does not constitute financial, or legal advice. Investment advice in an advisory capacity can only be rendered after delivery of PrairieView Wealth Partners, LLC’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and PrairieView Wealth Partners, LLC.